If you’re looking for a mobile app focused bank, right now there’s a GO2bank promo from Swagbucks.

It’s a checking account with the option to open a savings “vault” or sign up for a credit building secured card.

I’ll fill you in on the details below.

I may receive payments or incentives for sign ups and clicks generated through links on this page. Please see the full disclosure for more information. Thank you for the support!

Want to learn more about bank bonuses?

My starter guide will help you get up to speed on everything to do with bank offers.

The Fine Print

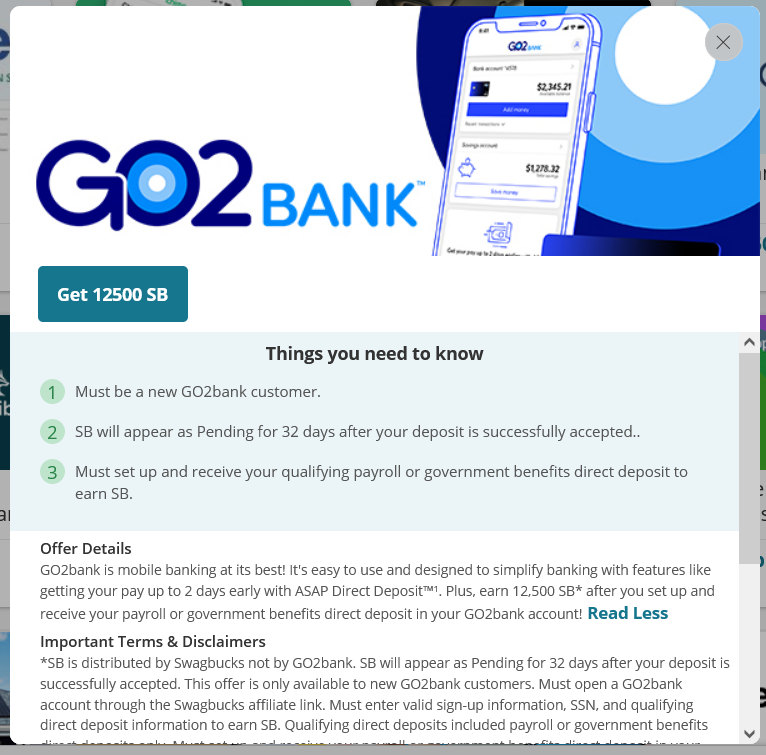

Bonus

$125 from Swagbucks, awarded as SB

Requirements

You must make a direct deposit into the account

Exclusions

Must be a new GO2bank customer

Fees

Monthly Fee: $5, waived if you received a direct deposit in the last month

Deadlines

Swagbucks doesn’t usually list deadlines, and this promo is no different.

Benefits

- $200 in overdraft protection for those who qualify

- Be paid from an employer 2 days early, or from the governement 4 days early

- Deposit cash into the account from many convenience stores

- Has a savings account with 4.5% APY on the first $5000

- Easy to get secured credit card to help build credit (see notes)

Notes

You can apply for the secured credit card if you received a direct deposit of at least $100 in the last 30 days. There’s no credit check and it’s set up to help you make payments in time.

Should You Take Advantage Of The GO2bank promo?

GO2bank is an internet based account that heavily focuses on mobile interaction. It’s affiliated with Green Dot, a financial technology company. Green Dot is a pretty well known company, so there shouldn’t be anything sketchy here.

The GO2bank promo is simple, with easy requirements and a solid bonus amount.

There’s an interesting opportunity to use GO2bank as a general financial home, given that they also offer a very strong savings rate and the chance to get an easy access secured credit card.

But the 4.5% savings rate only applies to the first $5000 in a vault. As far as I can tell it earns 0% on everything after that. And unusally for an online bank, there’s a monthly fee. I think there are better options if you can’t reliably meet the direct deposit requirement to waive that fee.

Considering that, I think the account could be good if you’re interested in multiple things they offer: you’d like to build credit and you’d like to stash some money below the limit.

The ability to fund the account with cash by going to retail stores is interesting, but how useful that is depends on how much cash you have to deal with.

What do you think? Let me know in the comments.

Start Banking With GO2bank

This link will take you to the Swagbucks offer page.